Income Tax Rate 2018-19 Pakistan

10 rows Last reviewed - 22 July 2022. To tax year 2020 with gradual decreased in rate by 1 each year upto tax year 2021.

Pdf Commentary On Supplementary Budget 2018 19 Sales Tax Act 1990 Restriction On Purchase Of Certain Assets Wajahat Rehman Academia Edu

The starting rate does not apply if taxable income exceeds the starting rate limit.

. Is defined in section 101 of the Income Tax Ordinance 2001 which caters for Incomes under different heads and situations. As per income tax exemption bill passed by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2018-2019. Personal Income Tax Rate in Pakistan averaged 2324 percent from 2006 until 2022 reaching an all time high of 35 percent.

If you are a salaried person living in Pakistan these income tax slabs will guide you about the tax you should pay as per the Income Tax Rules 2017-2018. The financial year for tax purposes for individuals starts on. Tax Slab Rate for Domestic Company.

All you need is to calculate your annual income because these slabs represent annual incomes. Income tax collection from salary persons has fallen sharply by 43 percent in fiscal year 201819 due to incentive granted by the previous PML-N government sources said on. FY 2018-19 9Direct Taxes Sales Tax Customs Duty.

A domestic company is taxable at 30. Hussain Mehmood Manager Taxation and Corporate Services. It is a frequently asked question.

GOVERNMENT OF PAKISTAN MINISTRY OF FINANCE REVENUE DIVISION ISLAMABAD 156 267 TY-2016 TY-2017 TY-2018. As per the Finance Act 2018-19 approved by Government of Pakistan this web based tax calculator applies income tax rates in Pakistan on taxable income of salaried. CLICK HERE TO CHECK INCOME TAX CALCULATOR PAKISTAN 2019-2020 As per the Finance Act 2018-19 approved by Government of Pakistan this web based tax.

Each percentage of income tax. Applicable Withholding Tax Rates. The Personal Income Tax Rate in Pakistan stands at 35 percent.

Updated up to June 30 2022. Pakistan levies tax on its residents on. Tax Rates 2018-2019 Year Residents The 2019 financial year starts on 1 July 2018 and ends on 30 June 2019.

KCO Rate Cards 2018-19 040718 By admin 2018-07. Lets discuss how much. It is simple to locate your slab.

4 of tax plus surcharge. The Finance Act has revised the rate for a banking company with zero rate for tax year 2018 and. 12 of tax where total income exceeds Rs.

Some of the common Pakistan source. Income tax in Scotland 201819 201819 rates 201718 201718 rates Starter rate band 2000 19 Basic. This rate card is being edited by Mr.

It S Not Only You Falling Taxes Mean Modi Government Too Is Feeling The Slowdown Pinch

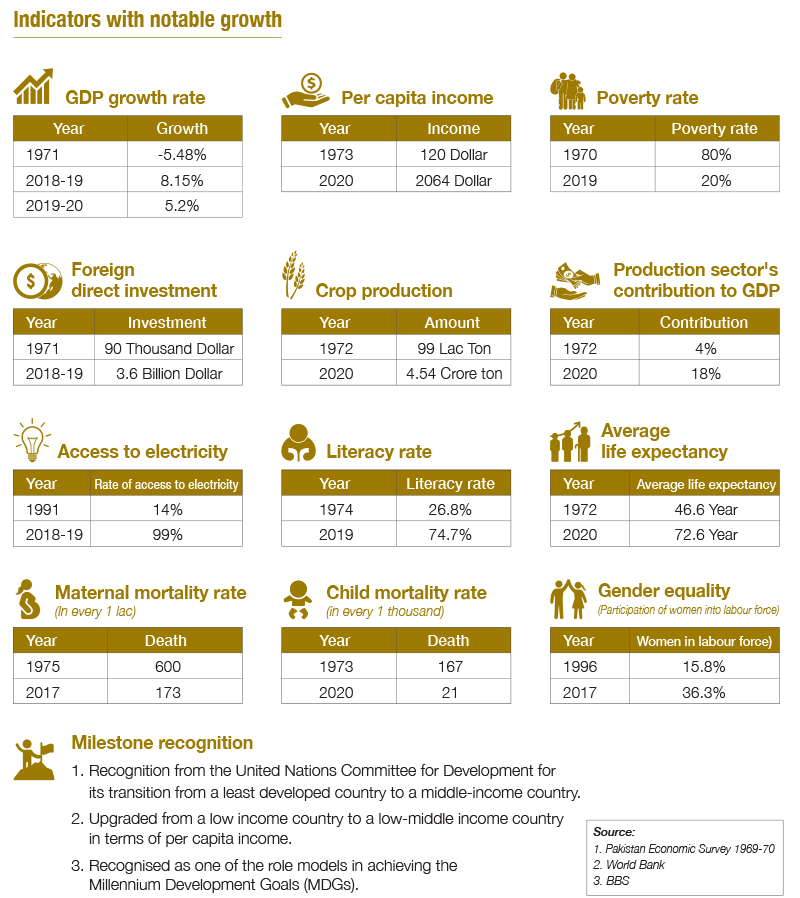

50 Years Of Independence Success Beyond Expectations Cpa News

Interim Budget 2019 No Change In Income Tax Slab Individuals With Income Upto Rs 5 Lakh To Get Tax Rebate Not Tax Exemption Budget News India Tv

Economic Survey Of Pakistan 2018 2019 Highlights Overseas Pakistani Friends

Income Tax Slab 2020 21 Pakistan Tax Rates For Salaried Non Salaried Fbr Ty 2020 Youtube

75 Lakh New Tax Filers Added To Income Tax List This Fiscal Official The Economic Times

Pakistan Budget 2019 20 Significant Proposed Amendments World News Observer

How Many Income Tax Returns Itrs Are Picked Up For Scrutiny Each Year Mint

Pakistan Corporate Tax Rate 2022 Data 2023 Forecast 1997 2021 Historical Chart

Corporate Tax India Indpaedia

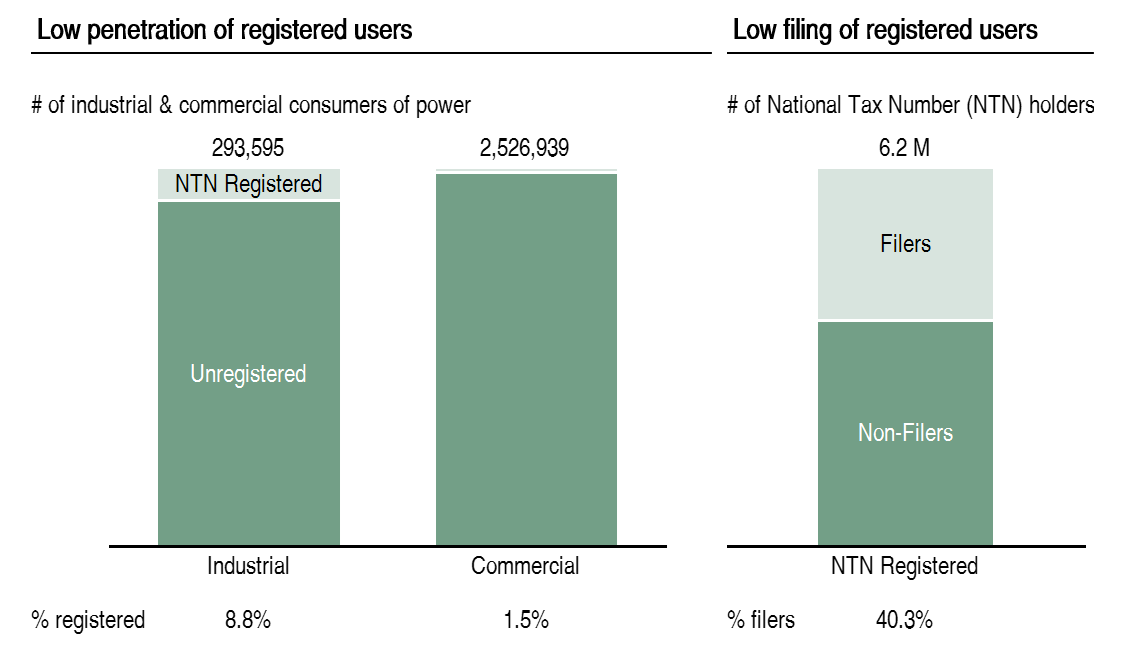

What Is The Issue With Low Collection Of Taxes In Pakistan

Budget 2018 19 Govt To Increase Prices Of Mobile Phones And Imported Cars Phoneworld

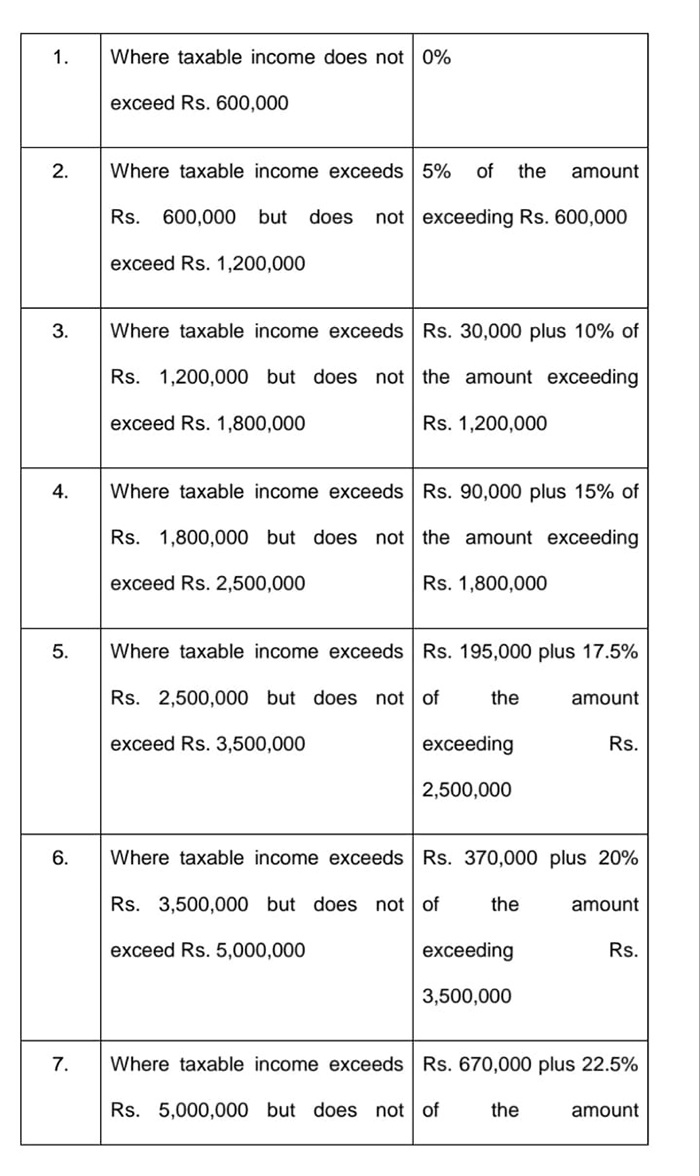

Federal Budget 2019 20 Minimum Taxable Income Revised For Salaried Non Salaried People

The Income Tax Relief Br Research Business Recorder

Tax Rates For Private Limited Companies Partnership Firms Sole Proprietor Or Salaried Person Youtube

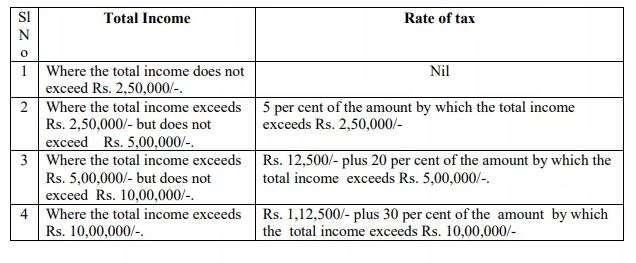

Income Tax Rates For Salaried Income For Fiscal Year 2018 19 In Pakistan

Revisit History Of Income Tax Slabs 1944 45 To 2020 21 In India